J.D. Power and LMC Automotive forecast sales down from September, but October retail light vehicle sales will be the highest for the month since 2001.

New-vehicle retail and total sales in October 2015 are expected to be the strongest for the month since 2001, according to a monthly sales forecast developed jointly by J.D. Power and LMC Automotive.

Benefitting from having five weekends—rather than the four weekends typical of most Octobers—sales in October 2015 are expected to exceed 1.1 million units, making it the strongest October since 2001, when automakers’ zero-percent financing incentives propelled new-vehicle retail sales to 1.6 million units.

Retail Light-Vehicle Sales

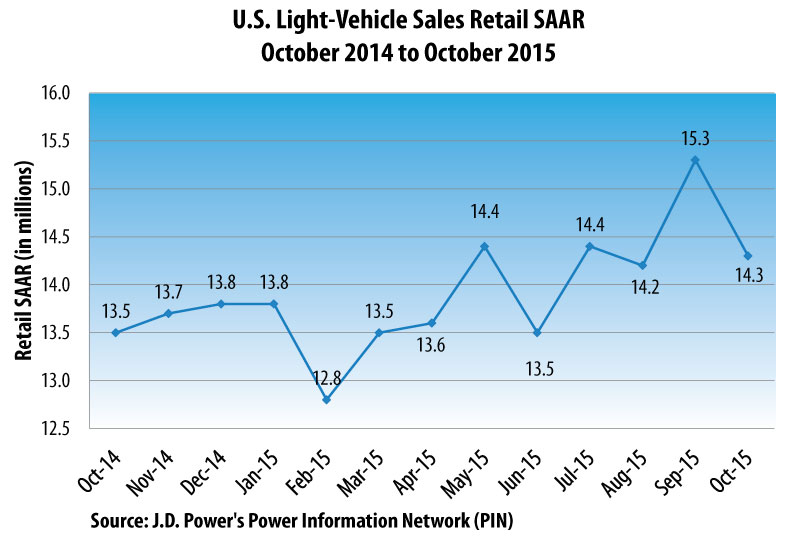

Although retail light-vehicle sales in October 2015 are down from 1.2 million units in September, they are up 5 percent on a selling-day adjusted basis compared with October 2014. The seasonally adjusted annualized rate (SAAR) for retail sales in October 2015 is expected to reach 14.3 million units, a 770,000-unit increase from the selling rate in October 2014 (13.5 million units). Retail transactions are the most accurate measure of true underlying consumer demand for new vehicles.

“September was a strong month—bolstered by the Labor Day weekend—so the expectation is that we would see some weakness is subsequent months, but that hasn’t been the case,” said John Humphrey, senior vice president of the global automotive practice at J.D. Power. “Through the first 18 days in October, retail sales are up 7 percent compared with the same period a year ago.”

While sales are strong, they have not been evenly distributed, as truck sales in October are up 15 percent year over year, while car sales have slipped 2.6 percent. Pickups and SUVs combined account for 58 percent of retail sales thus far this month.

“Given the continued pressure on car segments, manufacturers are responding with greater incentive spending on cars,” said Humphrey. “While incentive spending on cars has risen 16 percent year over year, truck incentive spending is up just 2 percent compared with October 2014.”

Car incentive spending is currently $650 per unit higher than truck incentive spending.

Total Light-Vehicle Sales

Total light-vehicle sales are expected to approach 1.4 million in October 2015, a 4.4 percent increase on a selling-day adjusted basis compared with October 2014. The SAAR for total sales in October is expected to be 17.4 million units, an 840,000-unit increase from the selling rate in October 2014.

Fleet volume is projected at 238,100 units, a 1 percent increase on a selling-day adjusted basis from October 2014. Fleet sales are expected to account for 17.2 percent of total sales in October 2015, down slightly from 17.7 percent in October 2014. After a stronger start to the year, since June fleet volume has settled in at a level below that of a year ago.

Sales Outlook

Light-vehicle sales are showing no signs of letting up. As a result, LMC Automotive is raising its 2015 total light-vehicle sales forecast to 17.3 million units from 17.2 million units and its retail light-vehicle forecast to 14.2 million units from 14.1 million units.

“The tenacious pace of auto sales since May, combined with the current favorable position of the U.S. economy, is increasing the level of upside potential to 2015 by 100,000 units, while nearly wiping out any downside risk,” said Jeff Schuster, senior vice president of forecasting at LMC Automotive. “Looking forward, the forecast for 2016 is 17.6 million units, but growing economic stability and consumer confidence could easily push light-vehicle sales toward 17.8 million units next year.”